Falls Church News Press article on Mayor Tarter’s SALT deduction testimony

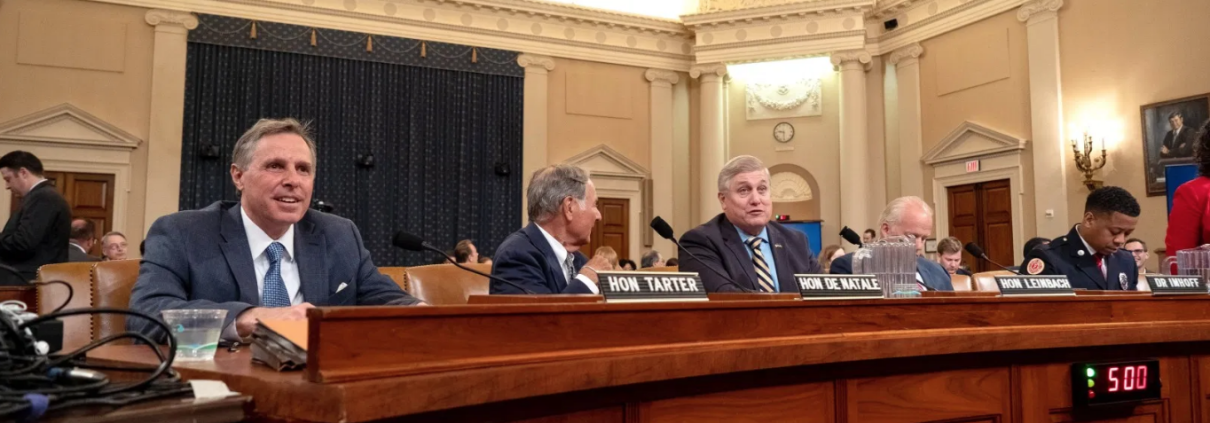

City of Falls Church Mayor P. David Tarter testified Tuesday before the U.S. House of Representatives’ House Ways and Means Subcommittee on Select Revenue Measures about the impact of the cap on the deductibility of state and local taxes (SALT) on federal returns. The $10,000 limit was a part of the 2017 tax legislation and restricts the ability of citizens to claim this long-standing deduction.

“It only hurts hardworking families and municipalities like mine,” Mayor Tarter said in his testimony. “When stacked up against the imposing costs of living (in the D.C. Metro area), many of our residents struggle to make house payments, pay taxes and make ends meet.”

He said, “The SALT deduction cap means that tax dollars that could have gone to the city are now going to the federal government, and there is less money available for essential local services like schools, police, and fire protection.”

Tarter was one of five panelists to testify about the harmful effects on their local communities of the SALT deductibility cap, joined by the mayor of Bayville, New York, an executive from Birch County, Pennsylvania, a school superintendent from Upper Arlington, Ohio and a firefighter union executive from Wisconsin.

Tarter was invited to testify by Falls Church’s congressman, U.S. Rep. Donald S. Beyer, Jr., who sits on the committee. During the hearing, Beyer heaped praise on Falls Church while welcoming Tarter. Beyer said he’s run a business with his brother in Falls Church for 46 years, and “It’s not a ritzy, fancy place. Most families are made up of two-parent workers who struggle to meet expenses.”

Using charts, Beyer compared average home prices to show that those in Falls Church, as an example, are almost three times those in, for example, Florence, South Carolina (Rep. Tom Rice, an outspoken Republican on the committee who assailed the panel for presenting a “false narrative,” representing the congressional district that includes Florence), thus making the cap on local real estate tax deductions more prohibitive for residents in places like Falls Church.

Tarter, whose full testimony is reprinted on page 7 of this edition, got an amused rise among Twitter responses to his testimony from those viewing his testimony on live TV from his comment, “There are no yachts in Falls Church.”

He said, “While our household income may appear to be high, when stacked up against the imposing cost of living, many of our residents struggle to make house payments, pay taxes and make ends meet. There are no yachts in Falls Church, just lots of hard-working families trying to get by in the high rent district. Most of the folks that I know are two income families who serve their country through work in government or the military and want the best education possible for their children.”

In addition to property taxes on an average home being over $11,000 a year, he said, “When you add in Virginia income and car taxes, SALT payments far exceed the new $10,000 cap,” meaning, he said, “that tax dollars that could have gone to the city are now going to the federal government, and there is less money available for essential local services like schools, police and fire protection.”

The new SALT deduction cap “double taxes citizens on these payments, and penalizes workers in high cost areas like my City,” he said, and he concluded by quoting Thomas Jefferson, who said, “The government closest to the people serves the people best.”

The cap as a double taxation issue was raised by other panelists, who cited Alexander Hamilton writing in the Federalist Papers and other taxation precedents in 1862 and 1913 that forbade the concept of double taxation.

Others cited the disproportionate benefit the 1917 tax overhaul has provided to the rich, to the top one and top 10 percent. Beyer noted that while 85 percent of the benefits of the tax reform accrue to the top one percent, 100 percent of the extra profits enjoyed by corporate moguls came from buybacks and dividends and not from investment in new research and development.

Congressmen from California, New York and Illinois, in particular, cited the heavy net federal tax burden on their states from the current system, where far more is extracted from the states than come back in services. It was noted that 45 percent of the cost of maintaining the nation’s roads and 40 percent of the cost of maintaining the nation’s bridges fall to local governments.s

Asked by the News-Press following the hearing whether he felt that Congress may be inclined to reconsider the cap on SALT, Tarter said, “If Congress is unable to restore the full SALT deduction, then increasing the cap or doing away with the marriage penalty for this deduction would be a good start.”

Meanwhile, local pundits couldn’t recall a time when a Falls Church City official had been called to testify before a U.S. Congressional committee before.